ERC-4337 and account abstraction will unlock the full potential of smart contract wallet, and Blocto has been an account abstraction wallet since 2019

Guest post by: ENDGAME DAO

What’s a wallet and why should I care?

To recap, everyone has an on-chain “public key” visible to all, which is like your account. Whenever a public key is created, there’s a private key linked to it.

Only the private key holder can sign transactions as the signer to move assets tied to the public key.

A wallet is an app that helps users create a public key, securely stores the private key, and connects users to dapps.

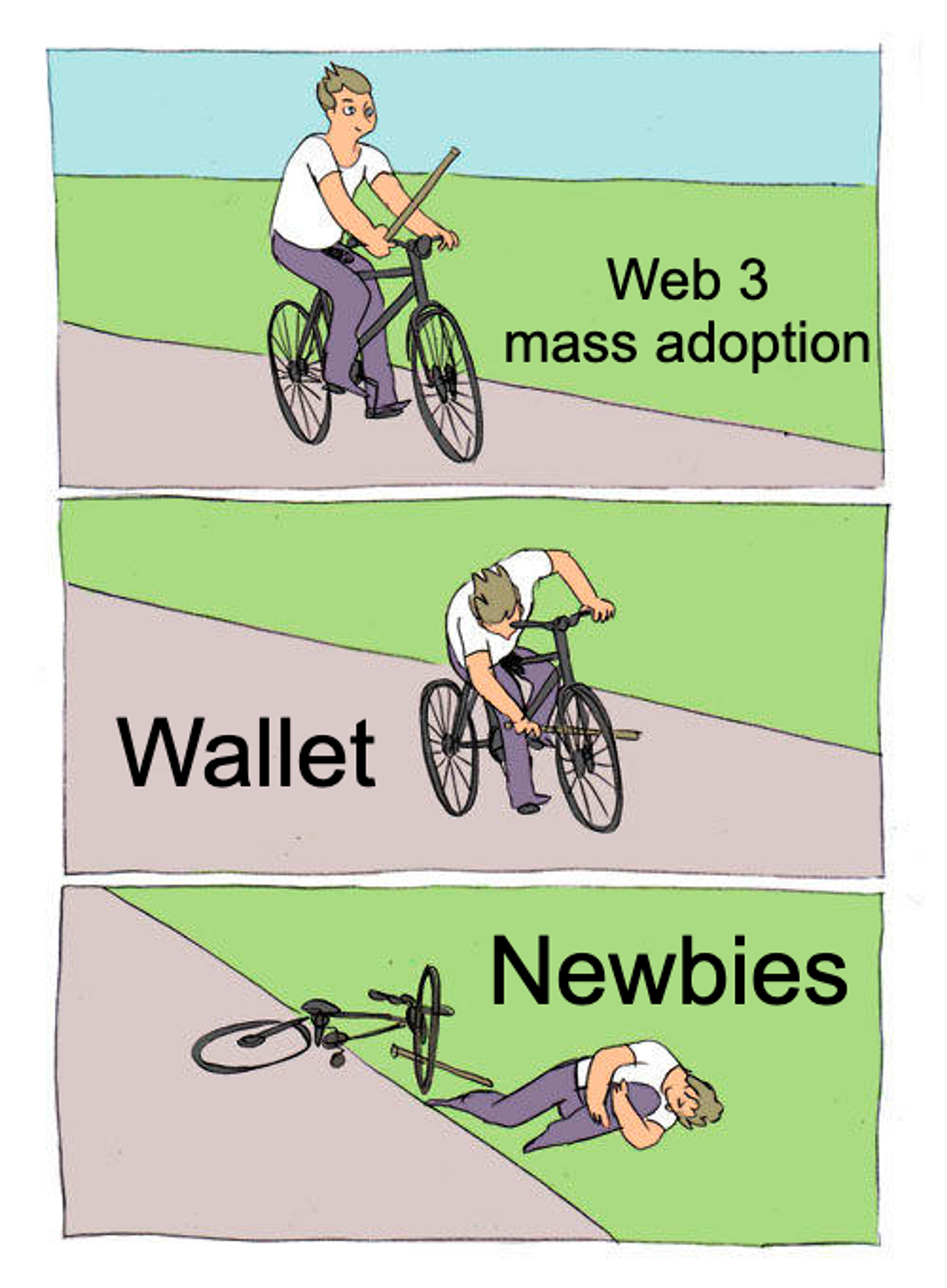

However, wallets in the web 3 world can be a real pain for newcomers. Unlike the simplicity of email logins, they’re far more complicated.

Creating a Metamask wallet on Ethereum, you’re faced with questions about secret phrases and the need to write down 12 random words. Misplace them? Too bad, they’re gone for good.

To use a dapp, you need ETH for gas fees. That means opening a CEX account, going through KYC, and trading fiat for ETH before finally accessing web 3.

These challenges make it difficult for the general public to embrace web 3, causing anxiety over wallet usage and concerns about sending coins to the wrong address.

As Vitalik said: “If you can make a wallet that a billion people will use — that’s a huge opportunity.”

We’re all aware of the wallet-related headaches, and that’s where the golden opportunity lies. So, understanding wallets isn’t just useful — it’s essential for tapping into web 3’s full potential.

What’s out there?

Cold wallet

Cold wallets—your crypto’s frosty fortress of safety. But what makes them so secure?

These offline storage systems are like a snug hideout for your digital assets, far from the chaotic web and pesky hackers. The secret? Your private key stays offline, akin to locking grandma’s cookie recipe in a vault, not sharing it online.

To access your cold wallet, you’ll need a hardware wallet (think: fancy USB stick). Connect it to a computer or smartphone, enter your PIN, and presto! You’re moving crypto securely.

Externally-Owned-Account (”EOA”) wallet

Building on the classic concept of transactions using private keys and user accounts, we get what’s called an EOA wallet, and the classic example of EOA is Metamask – the cute little fox that acts as our passport to the web 3 world.

There’s no way you haven’t used or spotted MetaMask. (And if you haven’t, I’m not sure why you’re here anon)

MetaMask is simple – it helps you generate public address and a linked private key, store the key on your device safely, and helps you interact with the dapps.

However, the weaknesses of EOA wallets are pretty obvious. As mentioned in the first section, the onboarding experience for EOA wallet is way too bad. Secret phrase, gas fees, and restoring from other devices are simply impossible for newbies to understand.

That’s why there are more and more options.

Multi-Party Computation (”MPC”) wallet

MPC wallets have become increasingly popular during the recent bear market, largely due to their ability to solve some of the most pressing issues with traditional wallets. But how do they work?

With an EOA wallet, all you need is a private key to sign transactions for a public key. However, if that private key is compromised, you’re out of luck – your assets are gone forever.

This is where MPC wallets come in. They break up the private key into several pieces, and only when all of the pieces are brought together can you sign transactions. This approach makes it much more secure and difficult to hack, and also simplifies recovery.

Advantages

- No single point of failure, as a complete private key is never stored on a single device, and there’s no seed phrase.

- Signing schemes can be adjusted to suit individual or organizational needs while maintaining the same address. Organizations can dynamically modify these schemes without having to update counterparties with new addresses.

- MPC wallets incur lower transaction and recovery costs, as they are represented as a single address on the blockchain with gas costs equivalent to regular private key addresses.

- Chain agnostic. There’s no need to deploy new contract on a new chain.

Disadvantages

- Inflexible. No possibility for gas fee extraction or subsidization. MPC are inherently EOAs with shared keys, limiting their capabilities. For example, MPC cannot have features such as batch transactions or automatic transactions.

- Off-Chain Accountability. Signing authorization policies and approval quorums are managed off-chain, potentially leading to centralized failures. Key shares should still be treated as cryptographic secrets. This approach may reduce transparency and necessitate more rigorous operational audits.

- Compatibility. Most conventional wallets, such as Ledger and Trezor, are incompatible with MPC since there is no seed phrase or single private key stored on a device.

- Transparency. Many MPC libraries and solutions are not open-source, making it difficult for the ecosystem to independently audit and integrate them. This may also hinder the ability to conduct post-mortems if something goes wrong.

What we believe will be the future – Smart Contract (”SC”) wallet

Smart contract wallets (or Contract Account, ”CA”), have gained significant traction recently, fueled by discussions around account abstraction and ERC-4337.

We believe that SC wallets are crucial for mass adoption, as they offer better user experience and customization options.

Before diving into smart contract wallets, let’s briefly discuss EOAs (mentioned above) vs CAs.

EOA (Externally-Owned-Account) vs CA (Contract Account)

There are two types of accounts on Ethereum – EOA and CA. They differ in that EOAs are controlled by a keypair, while CAs are controlled by code on the blockchain without a keypair.

CA can do much more than EOA, and offers much better user experience.

Advantages

- SC wallets offer greater flexibility than EOAs, enabling programmable tasks like automatic transactions, batch transactions, auto-staking, and more, opening up numerous real-life applications.

- No seed phrase required, eliminating a confusing aspect of wallets.

- Gas fees can be subsidized/sponsored for users, providing a seamless onboarding experience.

Disadvantages

- Limited adoption at the moment may cause accessibility issues with dapps for SC wallets (but this is likely to improve as adoption increases).

- SC wallet transactions can be costlier than EOA transactions due to increased complexity (but future updates on Ethereum and protocol levels could improve this issue).

- Wallet service providers need to deploy a smart contract when creating a new SC wallet for users, requiring gas fees that can be sponsored by the provider (while there’s no free lunch, the small gas fee unlocks vast potential for SC wallets, making it worthwhile).

Account abstraction (”AA”) and ERC-4337

Developers also believe SC wallets are the future and therefore have been trying to improve the infrastructure to make it more friendly to SC wallets. This is where account abstraction came from.

In very simple terms, account abstraction is an upgrade that makes SC wallets natively supported on Ethereum, instead of having users to use the cumbersome EOAs.

This means that there’s no need to remember complex secret phrases. Additionally, it offers enhanced features like multi-signature support, social wallet recovery, batch transactions, and gas subsidies from dapps, all integrated into your wallet.

Sounds good, right? It gets better — through ERC-4337, we’re one step toward fully implementing AA on Ethereum as it enables a common standard for relayer.

We won’t explain further about ERC-4337 here given its complexity. We’ll probably discuss it in a separate paper (maybe?).

Alright anon, we’ve discussed SC wallets extensively and shared our optimism about them. Now, let’s introduce an underrated wallet that deserves your attention.

The underestimated wallet — Blocto

Although there are several other SC wallets in the market (such as Safe and Argent) that have received significant coverage and recognition, we believe Blocto holds strong potential to stand out as trends in SC wallets, account abstraction, and ERC-4337 mature, thanks to its cutting-edge technology, proven track record, and capable team.

Blocto is the #1 wallet on Flow chain, top 3 on Aptos, and has expanded to Ethereum, BNB, Polygon, AVAX, SOL, Arbitrum and Optimism.

The most exciting part – Blocto has already been an Account Abstraction wallet since 2019, showcasing the teams’ vision.

The wallet is built by serial entrepreneurs, and backed by reputable investors.

Let us walk you through why we think it’s underestimated.

What makes Blocto special

- Blocto offers an exceptional mobile app, arguably the best wallet app in the web 3 space. It boasts a beautiful design, intuitive interface, and user-friendly experience. (Believe us, just download and try it out, and you’ll understand)

- The wallet app integrates various functions like swaps (BloctoSwap), an NFT marketplace (BloctoBay), and gaming, all in one place.

- While the web 3 community is enthusiastic about the new ERC-4337 standard, Blocto has been providing similar features since its launch in 2019.

- Smooth onboarding: Creating an account on Blocto is seed phrase-free and as simple as using an email and password, similar to web 2 experiences.

- Gas fee subsidization: Instead of buying tokens and paying gas fees, users can purchase Blocto points through in-app purchases using Apple Pay/ Google pay. Blocto then subsidizes the on-chain gas fees, making the process hassle-free!

- Auto-transactions, and more.

- Validation from its business partners including NPIXEL, Yahoo, MotoGP Ignition, CNN, and IPX (LINE Friends); and investors Mark Cuban, 500 Global, Roham (CEO of Dapper Labs), Animoca Brands, and more.

- Significant potential upside for the project with ERC-4337 upgrade:

- The key advantage for Blocto is that while competitors work on their first ERC-4337 solution, Blocto only needs to make its existing service compatible with ERC-4337, which is expected to be rolled out soon.

- A major component of ERC-4337 is the Paymaster, which unlocks the full potential for transaction subsidization, and enabling users to pay gas fees with ERC-20 tokens or off-chain payment methods. By integrating the Paymaster into Blocto, (1) dApps can easily subsidize fees to users through Blocto’s infrastructure, providing an improved user experience, and (2) Blocto can more easily generate revenue streams through the Paymaster logic, charging either dApps, users or payment service provider.

Blocto’s technology

There are 3 key features in Blocto’s technology, namely Meta Transaction, mixed-custodial model for key management, and SDK tools.

Meta transaction

Meta transaction was introduced back in 2018, which makes fee subsidization possible. Blocto makes the fee payment flexible by incorporating meta transaction.

In Blocto, the transaction fee can be paid by either:

- dapp builder, to improve user experience and the fee is treated like dapp operation cost;

- Blocto, as its user acquisition cost; or

- User, which is similar to normal transactions. However, they can pay with currencies other than the blockchain’s native currency. They can also top-up their balance with Apple/Google in-app purchase.

Mixed-custodial model for key management

In non-custodial systems, user takes full responsibility in their key management (e.g. Metamask). In custodial systems, 3rd party helps users manage their keys (e.g. exchange wallet).

Both are not ideal, as non-custodial system is too difficult for new user; custodial system is not trustless and too risky to sophisticated user. That’s why Blocto adopts a mixed-custodial approach:

- Custodial at first. When users first signed up, their key is stored in Blocto’s custodial service and they log-in with email and password.

- Non-custodial later. Later on when users get themselves familiar with wallet, they have the option to switch to non-custodial mode, by generating a new key on their device and replacing the ownership of the account.

To improve cross-device compatibility, Blocto offers various wallet SDKs, including JavaScript, iOS, Android, Unity, and Unreal (coming soon). These SDKs simplify the integration of Blocto wallet into dapps, no matter the device they’re built or used on. Additionally, by utilizing these SDKs, users won’t need to download extra wallet extensions or apps. Users might not even realize they’re using Blocto’s services to log in to a website.

Blocto’s performance highlight

- Over 1.6M users, with 300K-400K MAUs, growing at 10%+ month-over-month

- Closed Series A funding round in February 2023, with an $80M valuation, backed by Mark Cuban, Animoca Brands, 500 Global, IPX (LINE FRIENDS), and more

- Partnerships with Yahoo, Animoca Brands, MotoGP Ignition, LINE FRIENDS

- Leading wallet on Flow, with 85%+ users staking their $FLOW tokens via Blocto wallet

- Top 3 on Aptos, with over 400K unique Aptos users

$BLT tokenomics

Blocto already has their token out there — $BLT. Let’s dig in to their tokenomics.

Total supply and distribution

Total supply is 500M $BLT tokens, distributed according to below breakdown:

- Total insider: 36%

- Founders: 14% (6-month lockup and 42-month vesting)

- Team & shareholders: 6% (6-month lockup and 18-month vesting)

- Private sale: 16%

- Dapp mining: 25%

- Dev: Alignment of interest between dapp devs and Blocto ecosystem. Devs who wish to mine have to stake 10K $BLT and will receive rewards based on various metrics

- User: Rewards for users who keep more assets in their Blocto wallet

- Ecosystem: 16% (community management support, advisors, bounty program etc.)

- Accelerator fund: 16% (collaboration with new blockchain and integration with promising dapp)

- Staking reward: 5%

- Public sale: 2%

Circulation over 4 years time span.

Utilities

At the moment, there aren’t many utilities for $BLT besides staking.

However, as mentioned previously, the Paymaster component of ERC-4337 could unlock Blocto’s full potential of revenue generation. We’ve also seen Blocto team exploring new initiatives in the past, such as a launchpad in Q1 2022, which requires users to lock $BLT to participate.

These presents opportunities for the project: as technology updates, user adoption increases and possible tokenomics updates are implemented, the $BLT token could unlock its full potential.

Blocto’s team

A team of 40+ talented and experienced developers, designers and marketers, led by serial entrepreneurs Hsuan and Edwin.

The combination of the two founders is impressive. Hsuan focuses on product development and tracks industry trends on the technology side, while Edwin handles business development, strategies, company operations, and investor relations. The two founders complement each other well.

- Hsuan Lee (Co-founder and CEO): Hsuan has always been a well-known developer in the web 3 space. Prior to founding Blocto, he was the VP of engineering of Cobinhood, a top global crypto exchange at the time. He also worked at 17Live, Agoda and Yahoo as software engineer.

- Edwin Yen (Co-founder and COO): Edwin is a crypto OG and is well connected. Prior to Blocto, he was the head of business strategy of Cobinhood. He also worked in Schneider Electric and Armines.

Conclusion

We believe smart contract wallets hold the greatest potential for breaking down barriers to mass adoption, and we consider Blocto to be an underappreciated project with immense growth potential.